As we move through 2025, Australia’s property market is once again in the spotlight only this time, the conversation is a little more complex. After years of volatility, corrections, and surprising rebounds, many are wondering what lies ahead.

- Will the market cool further?

- Are prices set to rebound in key regions?

- And how should buyers, sellers, and investors position themselves?

In this blog, we’ll walk through the 2025 Australian property market outlook, exploring major trends, economic influences, and state-by-state forecasts to give you a well-rounded view of what’s in store.

A Quick Recap of 2024

Before we dive into forecasts, it’s worth reflecting on where the market stood at the end of 2024.

Last year saw a mixed bag. Some markets, like Perth and Brisbane, recorded steady gains thanks to tight housing supply and strong migration, while others like Sydney and Melbourne experienced signs of a housing market slowdown. Higher interest rates weighed on borrowing capacity, and affordability became a growing concern.

The rental market remained under pressure in most capitals, driven by population growth and construction delays. Meanwhile, investors began trickling back into the market after a cautious few years.

What’s Driving the Property Market in 2025?

Several economic and social forces are shaping the property market trends 2025. Let’s take a look at the big ones:

1. Interest Rates & Inflation

The RBA has taken a more cautious tone in early 2025, keeping interest rates steady after a long cycle of hikes. While borrowing costs remain elevated compared to pre-pandemic levels, stability has returned, giving buyers and investors more clarity.

Inflation, while still above target, is gradually easing, bringing some relief to household budgets and investor planning. Whether it’s navigating interest rate changes or choosing the right timing to enter the market, many investors are leaning on financial planning support to align property decisions with broader wealth-building goals.

2. Population Growth

With Australia’s migration program ramping back up, population growth is expected to be a key driver this year. This will likely support demand in both the rental and purchase markets, especially in growth corridors and regional hubs.

3. Supply Constraints

One of the recurring themes this year is housing undersupply. Labor shortages, planning delays, and cost blowouts in construction have all contributed to a slower rollout of new homes. This mismatch between supply and demand is expected to keep upward pressure on prices in certain pockets, despite broader affordability concerns.

Major Trends Shaping 2025

So what are the standout property market trends 2025?

1. Stabilisation, Not Boom or Bust

The extreme highs of 2021 and the abrupt corrections of 2022–23 are giving way to a more balanced market in 2025. Price growth is expected to be moderate, with capital cities generally avoiding sharp swings, though some regions will outperform others.

2. The Rise of Build-to-Rent

The build-to-rent model is gaining serious momentum, especially in Melbourne, Sydney, and Brisbane. As rental demand grows and traditional investors face tighter lending rules, institutional-grade rental developments are stepping in to fill the gap.

3. Technology in Real Estate

AI, virtual inspections, and predictive analytics are becoming part of the everyday buyer and agent experience. Smart tech is helping Australians find the right properties faster, and sellers better understand demand trends.

Australia Real Estate Predictions: What Experts Are Saying

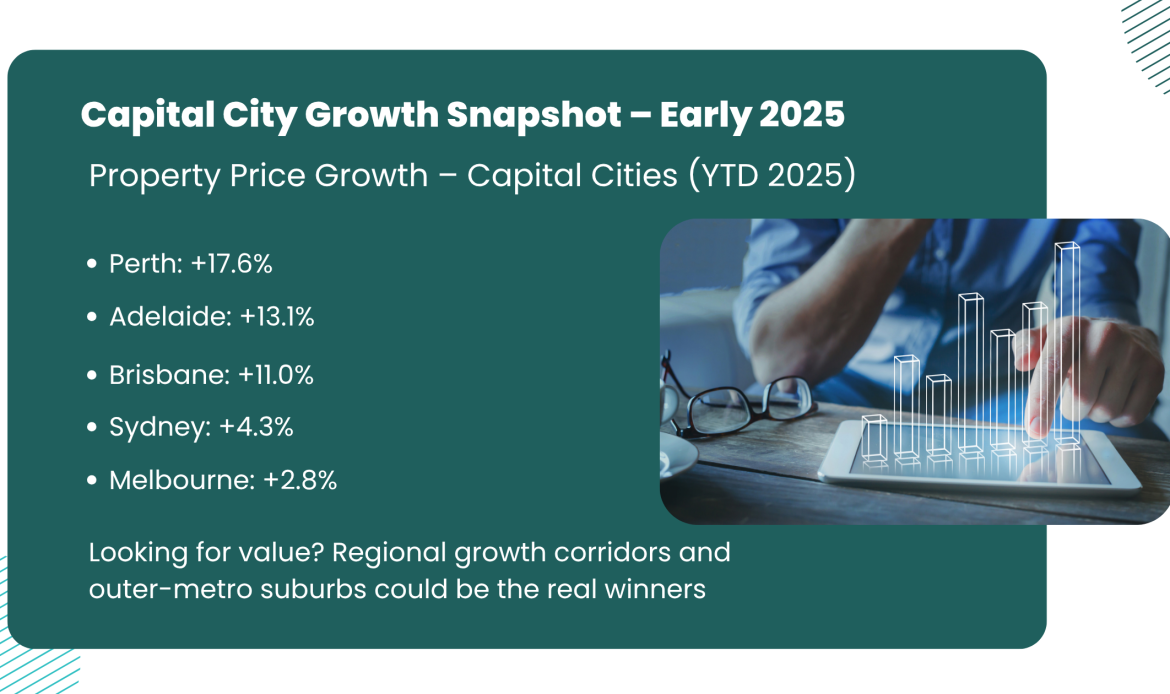

Data from the Global Property Guide shows that Australian dwelling values rose 6.6% over the past 12 months, with cities like Perth (+17.6%) and Brisbane (+11%) outperforming the national average. So, what do the experts think? Here are some widely discussed Australia real estate predictions for 2025:

- National home values are expected to grow between 3–6% on average, though highly dependent on region.

- Rental yields will remain strong in most capitals due to low vacancy rates.

- Regional markets will stabilise, with lifestyle migration slowing compared to the pandemic boom years.

- First-home buyer activity is likely to increase, particularly if rates remain on hold.

State & Territory Outlooks

A recent REA Insights feature highlighted Perth, Toowoomba, and the Sunshine Coast Hinterland among Australia’s hottest housing markets in 2025, fueled by strong migration, affordability, and infrastructure development. Let’s explore how things are shaping up across the country.

New South Wales (Sydney)

Sydney is showing signs of bottoming out after a soft 2024. Demand remains strong in well-connected suburbs and for townhouses over apartments. Investors are also slowly re-entering the market, thanks to high rental demand.

Victoria (Melbourne)

Melbourne’s recovery has been slower, partly due to higher dwelling supply and a more sluggish return to CBD living. However, infrastructure projects and migration are expected to boost outer-suburban demand.

Queensland (Brisbane & Gold Coast)

Still a favourite for interstate movers, Brisbane is likely to outperform other capitals again in 2025. The Olympics pipeline and continued population growth are major tailwinds. According to a recent realestate.com.au report, suburbs like Deagon, Woodridge, and Inala are emerging as affordable yet liveable options in Brisbane, offering solid investment potential and lifestyle appeal.

Western Australia (Perth)

The Perth property market forecast 2025 looks promising. With limited supply, ongoing demand from mining-linked employment, and relative affordability, Perth is set to see above-average growth. Several suburbs are already showing double-digit annual gains.

South Australia (Adelaide)

Adelaide remains steady. It won’t see the kind of highs some capitals will, but its consistency and rental demand make it attractive to risk-averse investors.

Tasmania, ACT & NT

Hobart is stabilising post-boom, while Darwin and Canberra are seeing modest activity. Government employment continues to underpin demand in the capital.

What’s Happening in the Rental Market?

Vacancy rates remain stubbornly low in most cities, and rents are expected to continue rising, albeit at a slower pace than 2023–24.

Some governments are exploring rental caps or tenancy reforms, but the balance between investor incentives and tenant rights remains tricky. Shared housing, co-living models, and longer leases are all becoming more common in response.

Risks to Watch

Despite the generally positive 2025 Australian property market outlook, it’s not without its risks:

- Housing affordability remains a key concern, especially for younger buyers

- Mortgage stress could rise if rates lift unexpectedly or wages stagnate

- Tax reform discussions, particularly around negative gearing or capital gains tax, may influence investor sentiment

- Geopolitical uncertainty or local shocks (like natural disasters) could impact market confidence

Opportunities for Buyers & Investors in 2025

If you’re in the market this year, here’s where opportunities might lie:

- First-home buyers can still find value in outer metro areas and regional centres, especially with government incentives.

- Investors should look for high-yield rental suburbs with strong population growth.

- Upgraders can benefit from a more balanced market, less competition and more time to negotiate.

Keeping an eye on local infrastructure projects, school zones, and rental vacancy data can also help buyers make more informed decisions. As demand picks up in high-growth regions, the back-end load for brokers has grown too. Support services like mortgage loan processing are helping professionals handle the increase in applications while keeping turnaround times competitive.

Final Thoughts

The 2025 Australian property market outlook paints a picture of cautious optimism. It’s not the dizzying highs of the past, nor the sudden drops we’ve seen recently. Instead, 2025 is all about stabilisation, resilience, and selectively finding value.

For buyers and investors willing to do their homework, this year could offer solid opportunities, particularly in markets like Perth, Brisbane, and parts of regional Australia. And with the right financial advice and long-term mindset, real estate remains one of the most stable ways to build wealth in Australia.

With the property market in a state of constant evolution, many brokers and advisers are relying on outsourced paraplanning services to stay compliant and efficient, especially when managing increased client demand during periods of market activity.

Frequently Asked Questions (FAQs)

1. Is the Australian property market expected to grow in 2025?

Yes, the market is expected to see moderate growth of around 3–5% nationally. While some capital cities like Sydney may remain flat, others like Perth and Brisbane are forecast to perform strongly due to tight supply, population growth, and affordability.

2. Which Australian city has the strongest property market outlook in 2025?

According to current trends, Perth has one of the most promising forecasts. The Perth property market forecast 2025 points to continued growth driven by low housing supply, relative affordability, and economic support from the mining and resources sector.

3. What are the major property market trends in 2025?

Key property market trends 2025 include stabilising house prices, increased investor interest, and the expansion of build-to-rent developments. Technology like AI-powered tools and virtual inspections is also transforming how Australians buy and sell property.

4. Will there be a housing market slowdown in 2025?

A broad housing market slowdown isn’t expected, but some areas may see softer growth. Rising affordability concerns and high interest rates will slow activity in pricier cities, while affordable regions with demand may continue to see price increases.

5. What should property buyers and investors watch out for in 2025?

In 2025, buyers and investors should monitor interest rate trends, housing supply, and policy changes. Paying attention to Australia real estate predictions and targeting areas with strong rental yields, population growth, and new infrastructure is key.