The Role of Outsourcing in Mortgage Brokerage Success

The mortgage brokerage industry operates in a fast-evolving environment marked by shifting market demands, rising customer expectations, and increasing regulatory complexities. To stay competitive, brokers must embrace innovative solutions that enhance efficiency, reduce costs, and drive client satisfaction. One such solution is outsourcing. By leveraging the expertise of third-party providers like Brokers Support Global, mortgage brokers can manage operations, adapt to market dynamics, and achieve sustainable success.

The Changing Landscape of Mortgage Brokerage

The mortgage industry has witnessed a seismic shift in recent years. Technological advancements, stringent compliance requirements, and fluctuating housing market trends have redefined how brokers operate. These changes present unique challenges:

- Increased Workload: Brokers must handle an overwhelming volume of documentation, loan approvals, and client interactions while maintaining high service standards.

- Regulatory Pressure: Compliance with ever-changing laws demands meticulous attention to detail, which can drain resources and time.

- Client Expectations: Today’s clients demand faster approvals, personalised services, and seamless communication, pushing brokers to rethink traditional processes.

- Cost Pressures: Rising operational expenses, including hiring skilled personnel and investing in technology, strain profit margins.

How Outsourcing Aligns with Market Dynamics

Outsourcing mortgage brokerage functions is more than a cost-cutting measure; it’s a strategic move to align with the evolving market landscape. By partnering with specialised providers like Brokers Support Global, brokers can tackle industry challenges effectively.

1. Improved Efficiency Through Specialised Expertise

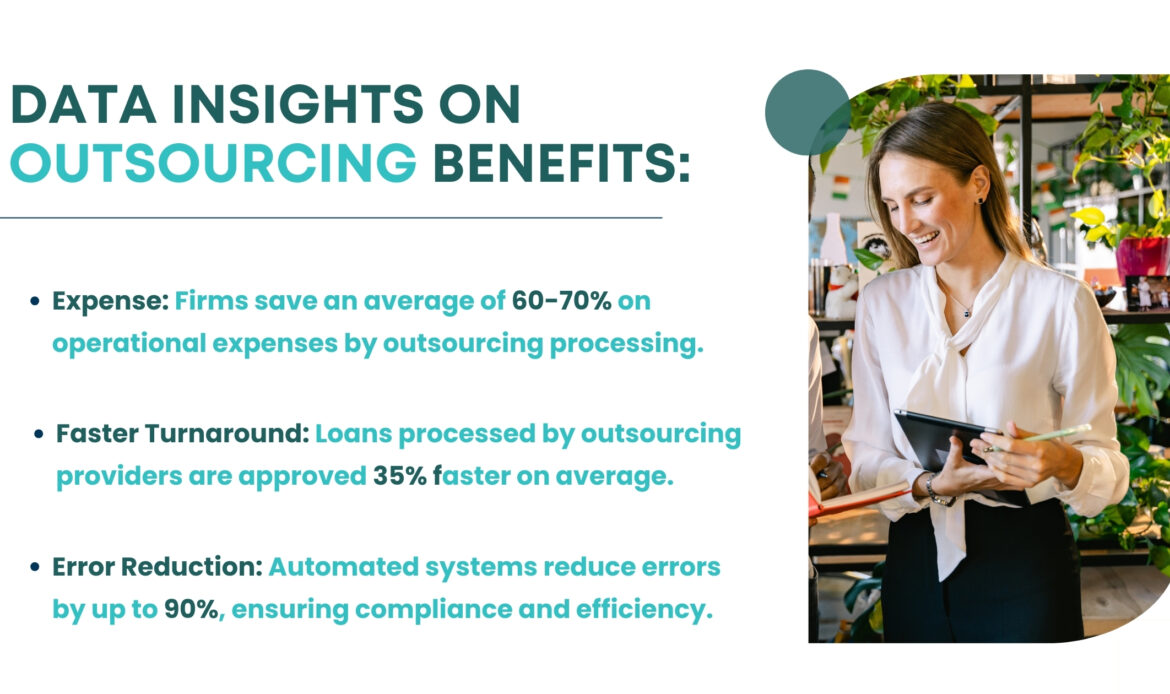

Outsourcing firms employ professionals who specialise in various aspects of mortgage processing, including document verification, credit analysis, and loan packaging. This expertise ensures faster turnaround times and reduces errors, enabling brokers to focus on client acquisition and retention.

2. Enhanced Scalability

Market fluctuations often result in inconsistent workloads. Outsourcing provides brokers with the flexibility to scale operations up or down based on demand. During peak seasons, brokers can handle higher volumes without compromising quality.

3. Cost Optimisation

By outsourcing back-office functions, brokers can significantly reduce overhead costs. Expenses related to hiring, training, and maintaining in-house staff are minimised, allowing firms to allocate resources strategically.

4. Focus on Core Competencies

Outsourcing non-core tasks such as data entry, compliance checks, and underwriting frees brokers to concentrate on client-facing activities and business growth.

5. Ensured Compliance

Leading outsourcing providers stay updated with the latest regulatory changes, ensuring that all processes adhere to compliance standards. This reduces the risk of penalties and enhances operational transparency.

Challenges Faced by Mortgage Brokers Without Outsourcing

- Delays in Loan Approvals: Limited resources and manual processes often lead to delays, affecting client satisfaction.

- High Error Rates: Handling complex documentation without expert support increases the likelihood of errors, resulting in rework and missed deadlines.

- Burnout Among Staff: Overburdened employees struggle to maintain productivity and morale, leading to high attrition rates.

- Missed Opportunities: Time spent on administrative tasks limits brokers’ ability to focus on market opportunities and build client relationships.

Why Choose Brokers Support Global?

As a leading provider of outsourced mortgage processing services, Brokers Support Global offers a comprehensive suite of solutions tailored to the needs of Australian mortgage brokers. Here’s what sets us apart:

1. Expertise in Mortgage Processing

Our team comprises industry veterans who bring unparalleled expertise to every aspect of mortgage processing, ensuring accuracy and efficiency.

2. Technology-Driven Solutions

We leverage advanced technology to automate repetitive tasks, reducing processing times and improving accuracy. Our tools integrate seamlessly with your systems, creating a cohesive workflow.

3. Customised Services

Understanding that every brokerage is unique, we offer personalised solutions that align with your business objectives and operational requirements.

4. Proven Track Record

Our clients have consistently reported faster loan approvals, improved compliance, and enhanced client satisfaction after partnering with us.

5. Competitive Edge

By outsourcing to Brokers Support Global, brokers can position themselves as agile, efficient, and client-focused players in the market.

Case Study: Transforming a Mortgage Brokerage’s Operations

A mid-sized mortgage brokerage in Australia struggled with inconsistent workflows and high operational costs. By outsourcing their mortgage processing functions to Brokers Support Global, they achieved the following results:

- 40% Reduction in Processing Time: Automated workflows and expert oversight accelerated loan approvals.

- 30% Cost Savings: Outsourcing eliminated the need for additional in-house staff and technology investments.

- Improved Client Retention: Faster approvals and seamless communication boosted client satisfaction.

The Competitive Advantage of Outsourcing

Mortgage brokers must leverage every opportunity to stay ahead. Outsourcing provides the tools and expertise needed to:

- Adapt to market trends and regulatory changes.

- Deliver exceptional client experiences.

- Scale operations without increasing overhead costs.

- Maintain a competitive edge in a dynamic industry.

Bottomline:

The success of a mortgage brokerage hinges on its ability to adapt to market dynamics, meet client expectations, and operate efficiently. By outsourcing key functions to Brokers Support Global, brokers can achieve these goals and more. Our expertise, technology-driven solutions, and commitment to excellence make us the ideal partner for brokers aiming to thrive in a competitive market.