Revolutionising Financial Advisory Services

Paraplanning services have transformed how financial advisors and mortgage brokers manage their workload. By outsourcing repetitive tasks like compliance checks and financial reporting, advisors can focus on building stronger client relationships and driving business growth. In Australia, companies like Brokers Support Global are leading the way in offering tailored paraplanning solutions, empowering financial professionals to excel.

What Are Paraplanning Services?

Paraplanning services encompass a range of administrative and technical support functions essential to financial advisory, including:

- Preparing comprehensive financial plans.

- Conducting detailed client reviews.

- Performing compliance checks and ensuring accurate documentation.

By delegating these tasks, financial advisors can boost efficiency, meet deadlines, and improve service delivery, enabling them to focus on client-centric strategies.

Challenges Faced by Financial Advisors

- Time Management Issues – Financial advisors often juggle multiple responsibilities, from client meetings to ensuring compliance with stringent regulations. This workload can lead to reduced efficiency, missed growth opportunities, and burnout.

- Navigating Regulatory Compliance – Australia’s complex financial regulations demand precision and up-to-date knowledge. Failing to keep pace with these changes can lead to non-compliance and penalties, which may harm an advisor’s reputation.

- Cost Constraints – Hiring in-house paraplanning staff can be costly, especially for small to medium-sized firms looking to remain competitive.

Why Financial Advisors Are Switching to Outsourced Paraplanning

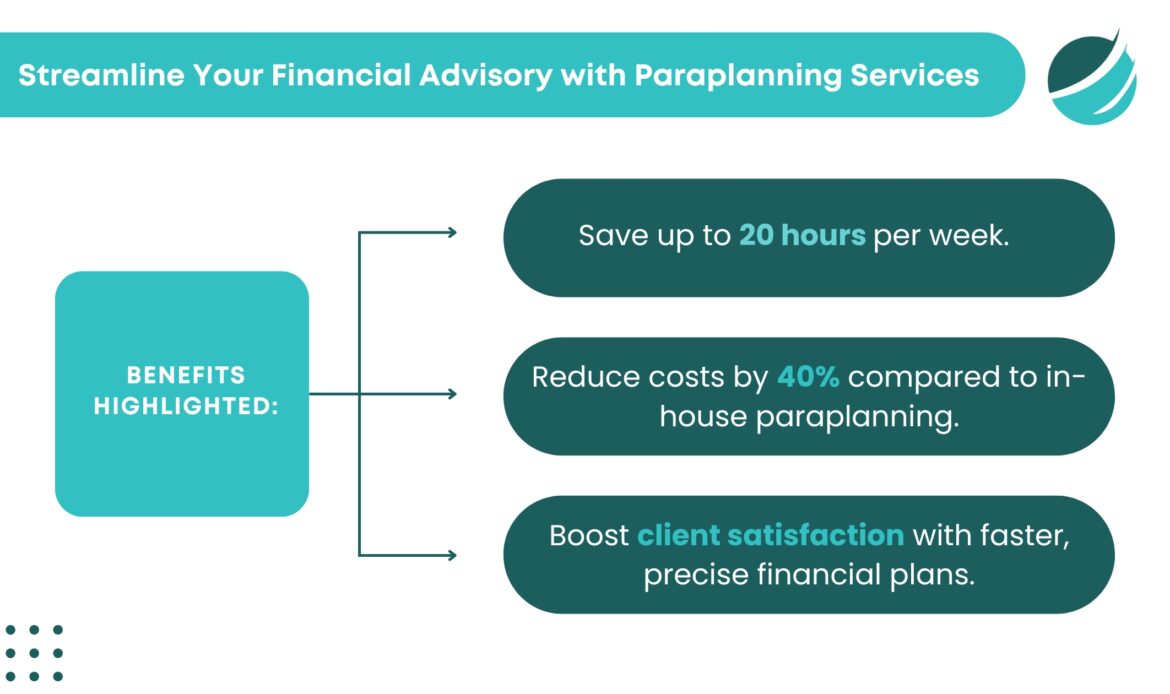

- Cost-Effectiveness – Outsourcing eliminates the need for in-house hiring, cutting overhead costs while maintaining high-quality services. Brokers Support Global offers affordable, scalable paraplanning solutions tailored to your needs.

- Access to Expertise – Outsourced paraplanners bring specialised industry knowledge and insights, ensuring precise deliverables and compliance with Australian regulations.

- Enhanced Productivity – By outsourcing time-intensive tasks, advisors can dedicate their time to high-value activities like client acquisition and retention, increasing overall productivity.

How Brokers Support Global Leads the Market

Tailored Solutions for Australian Financial Professionals

Brokers Support Global understands the unique challenges faced by Australian mortgage brokers, financial advisors, and agents. Their services include:

- Drafting detailed Statements of Advice (SoA).

- Performing thorough compliance checks.

- Generating comprehensive financial summaries and client-ready forecasts.

Seamless Integration with Your Workflow

Their experienced team integrates smoothly into your existing processes, ensuring a hassle-free onboarding experience. Whether you’re an independent advisor or part of a large firm, Brokers Support Global provides scalable solutions.

Quick Turnaround Times

In the competitive world of financial advisory, time is critical. Brokers Support Global delivers efficient, timely solutions, helping you meet deadlines and surpass client expectations.

The Future of Financial Advisory: A Hybrid Model

As technology and automation continue to advance, paraplanning services are becoming increasingly streamlined. However, the human touch remains indispensable, particularly when tailoring strategies to individual clients. Companies like Brokers Support Global combine the latest tools with personalised support, ensuring accuracy and efficiency.

Key Benefits of Partnering with Brokers Support Global

- Scalability: Services that grow with your business.

- Compliance Assurance: Expert guidance to navigate Australia’s financial regulations.

- Time Savings: Free up hours for strategic activities that drive growth.

Real-Life Impact: Success Stories

Financial advisors partnering with Brokers Support Global report significant productivity improvements and business growth. For example, a Melbourne-based advisor shared:

“Outsourcing paraplanning freed up 20 hours a week, allowing me to onboard more clients and significantly increase revenue.”

Tips for Transitioning to Outsourced Paraplanning

- Identify Repetitive Tasks: Pinpoint time-consuming activities that can be delegated.

- Choose the Right Partner: Evaluate providers like Brokers Support Global for their expertise and industry track record.

- Set Clear Expectations: Maintain clear communication to align objectives and achieve optimal results.

Conclusion: Stay Ahead with Outsourced Paraplanning

Outsourcing paraplanning is essential for scaling your practice. Brokers Support Global offers cost-effective, reliable, and customised paraplanning solutions to meet the evolving needs of Australian agents, mortgage brokers, and financial advisors.

Take the leap today and let Brokers Support Global handle your paraplanning needs so you can focus on what truly matters—building stronger client relationships and growing your business.