A Complete Guide to Mortgage Broker Fees: From Cancellation to Commissions

When you’re navigating the home loan process, mortgage brokers can be incredibly helpful. They act as intermediaries, connecting you with various lenders and helping you find the best mortgage products. However, just like any service, there are costs involved some of which may come as a surprise. One such cost that often raises questions is that mortgage broker charge a cancellation fee.

In this comprehensive guide, we’ll take a deep dive into the world of mortgage advisor fees, especially cancellation fees, and help you understand when and why they might apply. We’ll also explore other fees associated with mortgage brokers, such as commitment fees, administration fees, and more. By the end of this blog, you’ll have all the information you need, and you won’t have to look elsewhere for answers.

Why Do Mortgage Brokers Charge a Cancellation Fee?

Mortgage brokers play a vital role in securing the right loan for you. They compare various loan products, help you understand your options, and even negotiate on your behalf. However, this service comes at a cost.

Many brokers rely on commissions from lenders as their main source of income. When a borrower cancels the loan application after a broker has spent considerable time and resources, the broker may charge a cancellation fee to compensate for lost income.

How Do Cancellation Fees Work?

In most cases, the mortgage broker charges a cancellation fee when a borrower withdraws from a loan application after the broker has already put in the effort of gathering documents, submitting applications, and liaising with lenders. The cancellation fee serves as a way for brokers to recoup part of the time and resources they have invested in the process.

These fees are often non-negotiable and can vary depending on the broker’s policies and the amount of work they’ve already done. Some brokers may charge a flat fee, while others may charge based on the effort expended in the loan process.

Types of Fees Mortgage Brokers Charge

While cancellation fees often grab the most attention, there are several other types of fees that mortgage brokers may charge. Understanding these fees upfront can help you make an informed decision when working with a mortgage advisor.

1. Commitment Fees

A commitment fee is charged when you commit to proceeding with a mortgage application. This fee is usually a percentage of the loan amount and is charged to cover the broker’s initial efforts in arranging the loan. It’s typically non-refundable, even if you decide to cancel the application later on.

2. Administration Fees

These fees cover the administrative work that brokers do to process your loan application. They may include costs related to document verification, liaising with lenders, and handling any paperwork required during the application process. Administration fees are often charged upfront or added to the final loan cost.

3. Small Loan Fee

If your loan amount is on the lower end, some brokers may charge a small loan fee to compensate for the additional time and effort required to process smaller loans. These fees can be a flat rate or based on the loan amount.

4. Complex Loan Fee

Brokers may also charge a complex loan fee if your loan application involves complicated financial details, such as multiple income sources, credit issues, or other non-standard circumstances. These loans require more time and effort, so brokers may charge an additional fee to cover the extra work involved.

5. Commission Clawbacks

A commission clawback occurs when a lender demands a portion of the commission paid to the broker, typically because the loan is paid off early or canceled. This can happen if a borrower refinances their loan or sells the property within a short time of obtaining the mortgage.

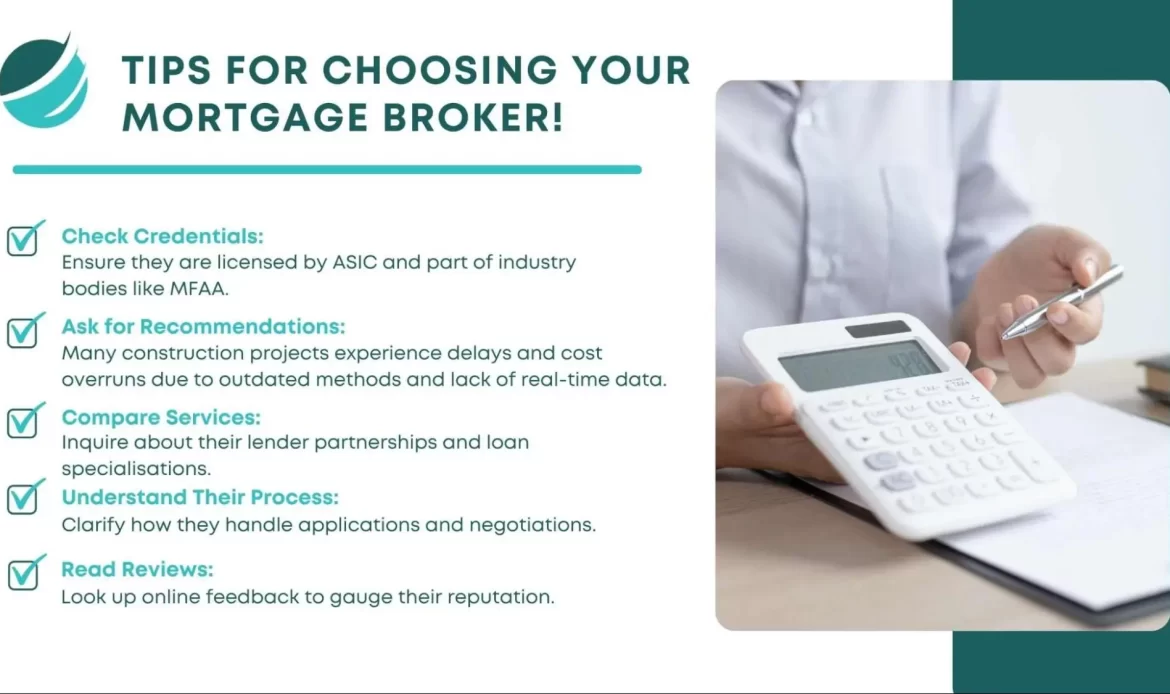

How Do I Get an Understanding of These Fees?

Understanding the various fees mortgage brokers charges can seem overwhelming, but it doesn’t have to be. Here’s how you can ensure there are no surprises:

- Read the Fine Print: Always ask your mortgage broker for a detailed breakdown of all the fees they charge. It’s essential to understand not just the cost of the loan itself, but also any associated fees that could apply.

- Ask Questions: Don’t hesitate to ask your broker to explain any fees you don’t fully understand. A transparent and reputable broker will be happy to clarify the details for you.

- Compare Brokers: Different brokers may have different fee structures. It’s worth shopping around to ensure you’re getting the best deal.

Consult with a Financial Advisor: If you’re unsure about the fees or need assistance in understanding them, consider consulting with a financial advisor. They can provide valuable insights and help you navigate the complexities of mortgage broker fees.

How Much Do Mortgage Brokers Charge?

Mortgage brokers charge various fees depending on the complexity and type of loan. These may include administration fees, small loan fees, and complex loan fees, which can add to the overall cost of securing a mortgage.

Some brokers may also have a mortgage broker charge a cancellation fee if the loan does not proceed, covering the work already completed. Additionally, commission clawbacks can apply if a loan is repaid early, impacting the broker’s earnings. The exact costs vary between brokers and loan structures, so it’s best to check with your broker for specific details.

Are Cancellation Fees Legal in Australia?

You may be wondering: are cancellation fees legal in Australia? Yes, cancellation fees are generally legal as long as they are disclosed upfront and are included in the broker’s service agreement. Mortgage brokers are required to be transparent about any fees they charge, including cancellation fees, before you agree to their services.

According to the Australian Securities and Investments Commission (ASIC), brokers are required to act in the best interests of their clients, which includes ensuring that all fees, including cancellation fees, are clearly communicated. In light of the Best Interests Duty, brokers must provide transparency in all aspects of their services, including their fees.

How Are Mortgage Brokers Paid?

Mortgage brokers are typically compensated in two ways:

1. Upfront Commission

Brokers usually receive a commission from the lender when you secure a loan through their services. This is often a percentage of the loan amount and is typically paid when the loan is settled.

2. Trail Commission

In addition to upfront commission, brokers may also receive a trail commission for the life of the loan. This is a smaller percentage of the loan amount and is paid regularly by the lender as long as the loan remains active.

These commissions are usually the primary way brokers are paid, but additional fees may be charged for more complex or time-consuming applications.

How Do Mortgage Brokers Clawback Fees Work?

A clawback fee occurs when a borrower refinances, repays, or cancels their loan shortly after it has been settled. Lenders pay brokers an upfront commission, but if the loan is canceled or paid off early, the lender may ask the broker to return all or part of that commission.

For example, if you take out a loan and decide to refinance it within the first two years, the lender may initiate a clawback fee and ask the broker to return the commission they were paid. This protects the lender from losing money if the loan is not maintained for the agreed-upon period.

Recent changes in the broking industry have made commission clawbacks a more common topic of discussion. The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry and subsequent reforms have made it essential for brokers to act in their clients’ best interests. This includes ensuring that clients are fully aware of potential clawback fees, which can be a significant factor in their decision-making.

How Do Mortgage Brokers Cancellation Fees Work?

As mentioned earlier, cancellation fees are charged when a borrower cancels a loan application after the broker has invested significant time and effort into the process. These fees can vary based on how much work has already been completed and the broker’s fee structure.

In some cases, the cancellation fee may be a flat rate, while in others, it may be calculated based on the resources spent on the application. It’s important to understand these fees before proceeding with a broker’s services to avoid unexpected costs.

Conclusion

Understanding the fees that mortgage brokers charge is crucial for anyone navigating the home loan process. From cancellation fees to commitment fees, small loan fees, and complex loan fees, it’s important to know what to expect before engaging with a broker.

While these fees are legal and often necessary to compensate brokers for their time and effort, transparency and clear communication are key to ensuring you aren’t hit with unexpected charges.

Always take the time to read the fine print, ask your broker questions about any fees, and ensure that all charges are clearly explained before you commit to a mortgage broker. With the right knowledge, you can confidently navigate the mortgage process and avoid unnecessary costs along the way.

For more detailed information, you can refer to resources such as the Australian Securities and Investments Commission (ASIC) or consult with a financial advisor to ensure you’re getting the best deal.

FAQs

- What is a mortgage broker cancellation fee?

A mortgage broker cancellation fee is charged when a borrower withdraws from a loan application after the broker has invested time and resources. The fee compensates the broker for the work done, which may include document submission and liaising with lenders. - Are cancellation fees legal in Australia?

Yes, cancellation fees are legal in Australia as long as they are disclosed upfront in the mortgage broker’s service agreement. Brokers must follow the Best Interests Duty, ensuring transparency and clear communication about any fees they charge, including cancellations. - What other fees do mortgage brokers charge?

Apart from cancellation fees, brokers may charge commitment fees, administration fees, small loan fees, complex loan fees, and commission clawbacks. These fees depend on the broker’s policies and the complexity of the loan application process. - How much do mortgage brokers charge in fees?

Mortgage broker fees vary depending on the loan type, lender, and services provided. Some brokers charge service fees, while others earn through lender commissions. Additional costs may include commitment, administration, or cancellation fees. It’s advisable to discuss the fee structure upfront to understand any potential charges. - How are mortgage brokers paid?

Mortgage brokers are primarily paid through commissions from lenders. This can include upfront commissions (a percentage of the loan amount) and trail commissions (ongoing payments from the lender for as long as the loan remains active).

6. How can I avoid mortgage broker cancellation fees?

To avoid cancellation fees, ensure you fully understand the terms of the agreement before proceeding. Communicate any changes in your decision early with the broker and review the fee structure in advance to prevent unexpected charges.