Choosing between a fixed or variable home loan can feel like standing at a financial crossroads, especially in 2025, when the economic climate is anything but quiet. With interest rates stabilising (for now) and lenders rolling out a range of offers, borrowers are faced with a big decision: do you lock in your rate and enjoy certainty, or ride the market in hopes of saving more long term? For many, even comparing products can feel overwhelming, prompting a growing number of Australians to explore outsourcing mortgage loan research and support to professionals who can help cut through the clutter

Let’s unpack the key differences, pros and cons, and what the 2025 numbers are saying.

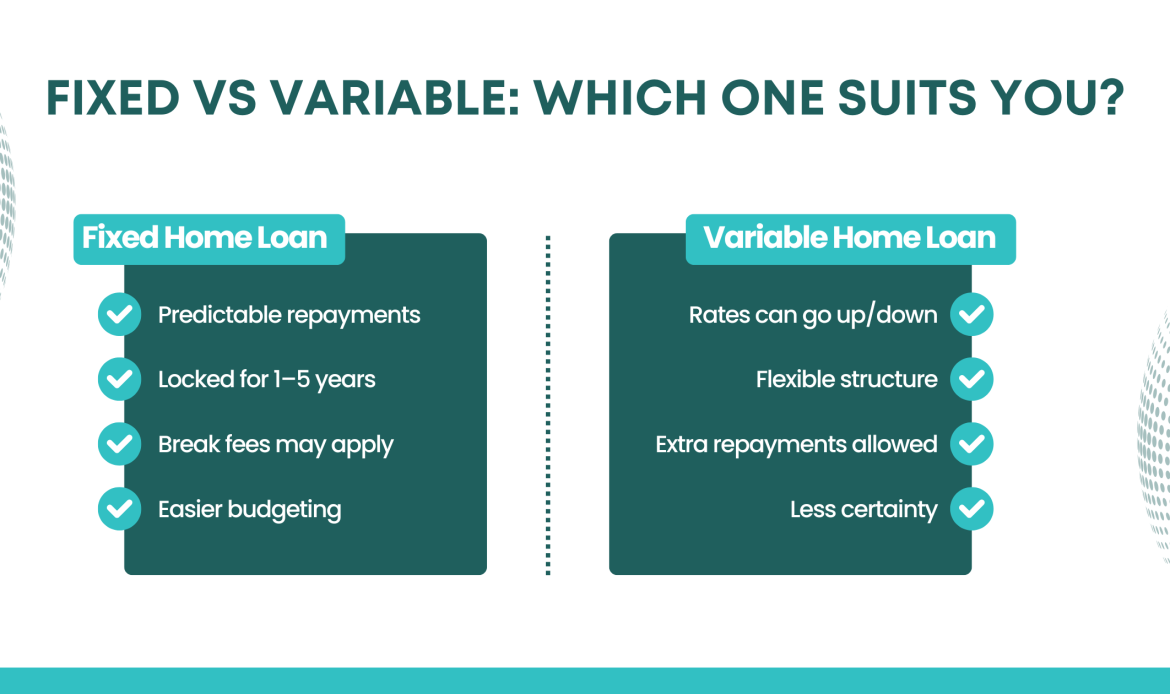

What is a Fixed Home Loan?

A fixed home loan is exactly what it sounds like, the interest rate stays locked in for a set period, typically between 1 and 5 years. It doesn’t matter what happens in the market or how often the RBA moves the cash rate, your repayments remain the same.

If you value predictability, a fixed rate home mortgage could give you peace of mind. It’s especially appealing for first-time buyers or households working within tight budgets.

Pros:

- Certainty over repayments

- Protection from interest rate hikes

- Easier to budget

Cons:

- Less flexibility, early repayments or refinancing often come with break fees

- You may miss out on savings if interest rates drop

- Limited access to features like offset accounts or redraw

What is a Variable Home Loan?

A variable home loan, on the other hand, moves with the market. The variable interest rate mortgage you start with might not be the one you have in six months.

Lenders can change your rate depending on the Reserve Bank’s decisions, market pressures, or their own funding costs. While that can be risky, it also means more flexibility and often greater access to loan features.

Pros:

- Flexibility to make extra repayments or exit early.

- Access to features like redraw and offset accounts.

- Potential to benefit from rate drops.

Cons:

- Less predictable budgeting.

- You’re exposed to rate increases.

- Monthly repayments can fluctuate.

Fixed Rate vs Variable Rate: 2025 Home Loan Comparison

Let’s get into the heart of the matter, fixed rate vs variable rate in 2025. Right now, Australia is in a phase of cautious optimism. Inflation is cooling off, and the RBA has signaled that we may not see as many aggressive hikes as we did in previous years.

The latest ABS lending indicators show that new owner-occupier and investor loan commitments have dipped slightly in early 2025, reflecting cautious borrowing behavior even as approvals recover year-on-year. But lenders are still pricing in some uncertainty.

Average Home Loan Rates in 2025 (as of June):

- Fixed interest rate on home loan (3-year term): 5.89% – 6.29%

- Variable interest rate mortgage: 6.05% – 6.45%

While fixed rates are slightly lower in some cases, lenders are offering cashback deals, discounts, and loyalty bonuses for variable loans, particularly for refinancers.

According to realestate.com.au, some lenders have already dropped fixed, and variable offers below 5.5% following the RBA’s latest cash rate cut, making 2025 one of the most competitive markets we’ve seen in years.

So, the difference between fixed and variable loan options today often comes down to features and flexibility, rather than just headline rates.

Who Should Consider a Fixed Loan in 2025?

A fixed rate home mortgage is ideal for:

- First-time buyers:

Locking in your repayments helps manage finances during a new life stage. - Budget-conscious households:

You know exactly what your repayments will be, no nasty surprises. - People expecting rates to rise:

If you’re convinced we’re not done with increases, fixing now could save money.

However, you’ll need to consider:

- Are you planning to refinance, sell, or make extra repayments during the fixed period?

- Are you okay with paying break costs if you need to exit early?

Can you live without features like an offset account?

Who Might Prefer a Variable Loan?

A variable interest rate mortgage may be better suited for:

- Homeowners planning to pay extra:

You’ll enjoy greater flexibility to reduce your principal faster. - Borrowers who want flexibility:

If you think you might refinance or sell, variable loans have fewer exit costs. - Investors looking for loan features:

Offset accounts, interest-only periods, and redraw facilities are more common with variable products.

That said, you’ll need to prepare for changing repayments and factor in a rate buffer in your budget planning.

Split Loans: Best of Both Worlds?

Not sure where you stand? A split loan could offer a compromise. It lets you fix a portion of your loan while keeping the rest variable.

For example, a 60/40 split could give you certainty on part of your repayments, while still letting you pay extra on the variable portion. Many lenders now allow borrowers to structure their loans this way with minimal fuss.

If you’re unsure how to structure your loan split or want help modelling repayments, mortgage process outsourcing can give you access to experienced professionals who specialise in loan structuring without the cost of hiring in-house experts.

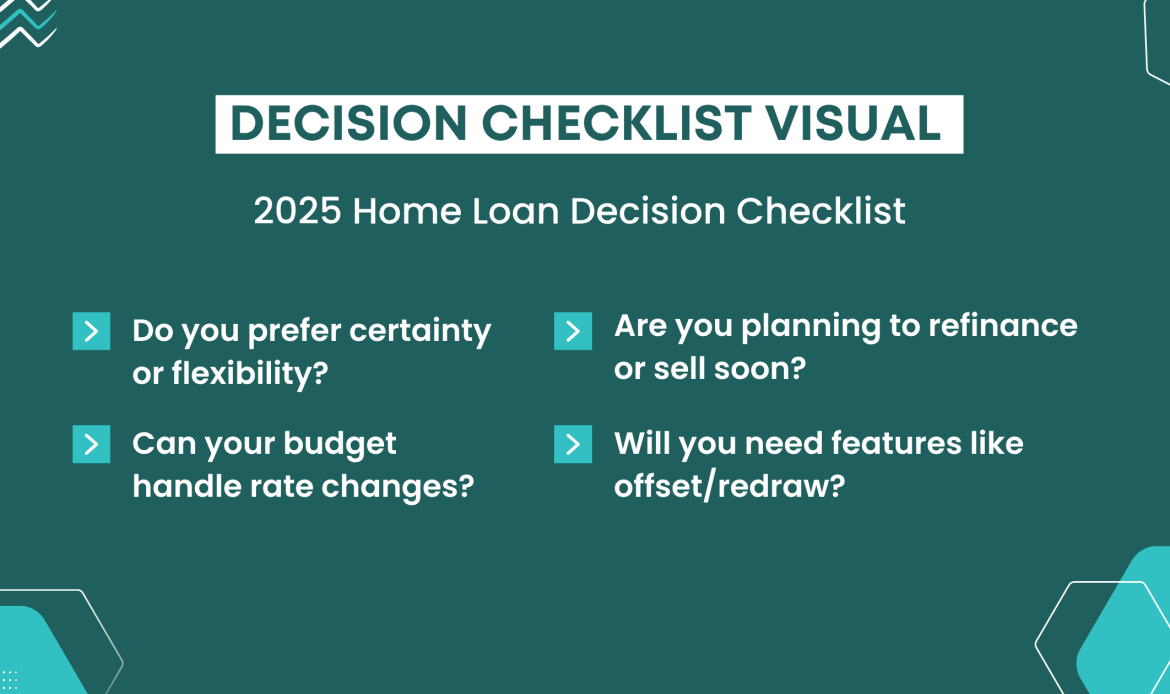

How to Decide in 2025: Questions to Ask Yourself

Here are some key considerations when weighing up fixed or variable home loan options:

- What are your financial goals for the next 3–5 years?

Planning a family, expanding a business, or buying another property? Fixed might work well. Planning to sell or refinance? Consider variables. - Do you need flexibility?

If you want to make extra repayments or access redraws, variable is typically better. - How risk-tolerant are you?

If rate hikes make you anxious, fixing your rate could be worth the premium. - Do you value certainty or savings?

Fixed rates offer predictability. Variable loans may offer savings—if rates drop or stay stable.

Tips Before You Lock Anything In

- Use comparison rates, not just advertised rates. These give a better sense of the true cost once fees and features are included.

- Speak to a broker or consider engaging an outsourced loan expert, they can analyse multiple lender offers, compare rates and features, and help align your loan choice with your financial goals.

- Read the fine print, especially around break costs, redraw conditions, and offset account access.

- Run different scenarios, using loan calculators, factoring in potential rate hikes or drops.

- Reassess regularly, your loan shouldn’t be set-and-forget. As your situation evolves, so should your mortgage.

Final Thoughts: There’s No One-Size-Fits-All Answer

In 2025, the choice between a fixed or variable home loan isn’t about chasing the lowest rate. It’s about matching your loan to your life.

If you want certainty, protection, and structured budgeting, fixing might be the right move. If you want flexibility, the ability to pay down faster, and you’re okay with a little risk, variables could be your friend. And with the interest rate outlook still uncertain, some experts are forecasting both volatility and potential cuts over the next 12–18 months. Forbes Advisor highlights that global economic pressures and inflation trends could drive further rate shifts, influencing lender strategies.

For many Australians, a split option is emerging as a smart, balanced strategy.

And remember, your circumstances won’t stay the same forever. Review your home loan every 12–24 months to ensure it still suits your needs. If you’re time-poor or not sure where to start, working with a broker or outsourcing mortgage reviews can save you the mental load and help uncover hidden value.

If you’re weighing up how much of the home loan journey you want to handle yourself vs delegate, this guide on in-house vs outsourcing mortgage loan processing breaks down the pros, cons, and costs to help you decide what suits your workflow best.

Frequently Asked Questions (FAQs)

Q1: What’s the biggest difference between fixed and variable loan types?

The biggest difference lies in how your repayments change over time. A fixed interest rate on a home loan stays the same during the fixed term, giving predictable repayments. A variable rate, however, changes with the market and can impact your cash flow depending on interest rate movements.

Q2: Can I switch from fixed to variable mid-loan?

You can switch, but it often comes at a cost. Exiting a fixed loan early usually triggers break fees, especially if current rates are lower than your fixed rate. Always review your lender’s policy before switching to ensure its financially worthwhile.

Q3: Are fixed rates worth it right now?

Fixed rates are a solid option if you value certainty, especially in a market where interest rate changes are expected. They lock in your repayment amount, which is great for budgeting. However, you’ll likely give up flexibility and might pay more if rates fall unexpectedly.

Q4: Do variable loans always end up cheaper?

Not necessarily. A variable interest rate mortgage can be cheaper if interest rates drop or stay low and often comes with features like offset accounts and redraw. But if rates rise, your repayments could increase significantly. It’s about balancing risk and flexibility.

Q5: Is it possible to split between fixed and variable?

Yes, many borrowers opt for a split loan, part fixed, part variable. This lets you enjoy repayment certainty on one portion while keeping flexibility on the other. It’s ideal if you want to hedge your bets and balance risk with access to features like extra repayments.